TheTechMedia.com/wp-content/uploads/2021/04/get-app-300×225.png 300w, https://TheTechMedia.com/wp-content/uploads/2021/04/get-app-768×579.png 768w, https://TheTechMedia.com/wp-content/uploads/2021/04/get-app-800×603.png 800w, https://TheTechMedia.com/wp-content/uploads/2021/04/get-app.png 1098w” sizes=”(max-width: 1018px) 100vw, 1018px”>

TheTechMedia.com/wp-content/uploads/2021/04/get-app-300×225.png 300w, https://TheTechMedia.com/wp-content/uploads/2021/04/get-app-768×579.png 768w, https://TheTechMedia.com/wp-content/uploads/2021/04/get-app-800×603.png 800w, https://TheTechMedia.com/wp-content/uploads/2021/04/get-app.png 1098w” sizes=”(max-width: 1018px) 100vw, 1018px”>Zomato’s IPO has been nothing short of scintillating and is a legendary tale in the making. In its wake, other firms are gearing up for IPOs for well. Online insurance marketplace PolicyBazaar is one such firm, as the largest online insurance aggregator in the country has now filed a Draft Red Herring Prospectus (DRHP) with the Securities Exchange Board of India (SEBI) to raise no less than ₹6017.50 (approximately $809 million) via its IPO.

The IPO comprises of a fresh issue of ₹3,750 crores worth of equity shares and an offer for sale of ₹2,267.50 crores by existing shareholders and promoters.

This plan of PolicyBazaar is ambitious, no doubt, but after the Zomato IPO, the lines between possible and impossible are starting to blur. Many firms have already gone, or are planning to go public this year. PolicyBazaar joins a long list that includes messaging services platform Gupshup, Zomato, and Paytm, all of which have grown exponentially over the last year and are not going to try their luck in the public market.

The OFS would see the sale of up to ₹1,875 crores worth of shares by SVF Python II (Cayman) and up to ₹392.50 crores by others.

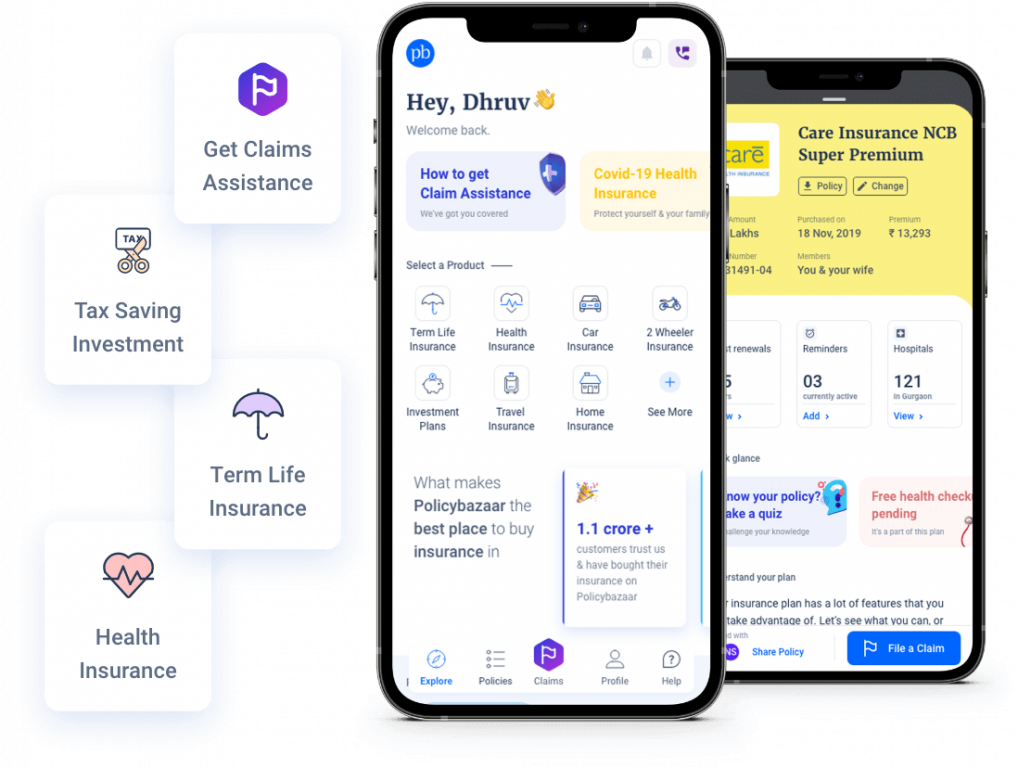

The Gurgaon-based PolicyBazaar said that the proceeds from the IPO would be utilized to find new opportunities for expanding its consumer base (including offline presence), making acquisitions and strategic investments, expanding beyond India, and general corporate purposes.

Backed by SoftBank, Tiger Global, China’s Tencent, and others, the 13-year-old start-up has evolved into a leader in the Indian online insurance sector, allowing users to avoid middlemen completely and compare prices and features of life, health, auto, travel, and property insurance policies from dozens of providers. It helps buyers submit claims, redeem paybacks and amend policies, and in a country where most Indians are ignorant of the importance of insurance or don’t have it- PolicyBazaar is a revolutionary firm seeking to fill the gaps.

The firm is already mulling over the idea to raise around ₹750 crores by way of a private placement of equity shares ahead of the IPO and is consulting with its book running lead managers (Kotak Mahindra Capital, Morgan Stanley, Citigroup Global Markets India, ICICI Securities, HDFC Bank, IIFL Securities, and Jefferies India) for the IPO.

“We expect our costs to increase over time and our losses will continue given the investments expected towards growing our business. We have expended and expect to continue to expend substantial financial and other resources on, among others, developing a physical channel and investing behind experiments,” PolicyBazaar said in its draft filing. “These efforts may be more costly than we expect and may not result in increased revenue or growth in our business.”

The start-up ecosystem continues to boom, and it is hoped that this golden age is here to stay.