TheTechMedia.com/wp-content/uploads/2021/07/zomato-new-featured-the-tech-portal-300×206.jpg 300w, https://TheTechMedia.com/wp-content/uploads/2021/07/zomato-new-featured-the-tech-portal-768×528.jpg 768w, https://TheTechMedia.com/wp-content/uploads/2021/07/zomato-new-featured-the-tech-portal-1536×1056.jpg 1536w, https://TheTechMedia.com/wp-content/uploads/2021/07/zomato-new-featured-the-tech-portal-2048×1408.jpg 2048w, https://TheTechMedia.com/wp-content/uploads/2021/07/zomato-new-featured-the-tech-portal-800×550.jpg 800w, https://TheTechMedia.com/wp-content/uploads/2021/07/zomato-new-featured-the-tech-portal-1160×798.jpg 1160w, https://TheTechMedia.com/wp-content/uploads/2021/07/zomato-new-featured-the-tech-portal-e1626320757607.jpg 1074w” sizes=”(max-width: 1024px) 100vw, 1024px”>

TheTechMedia.com/wp-content/uploads/2021/07/zomato-new-featured-the-tech-portal-300×206.jpg 300w, https://TheTechMedia.com/wp-content/uploads/2021/07/zomato-new-featured-the-tech-portal-768×528.jpg 768w, https://TheTechMedia.com/wp-content/uploads/2021/07/zomato-new-featured-the-tech-portal-1536×1056.jpg 1536w, https://TheTechMedia.com/wp-content/uploads/2021/07/zomato-new-featured-the-tech-portal-2048×1408.jpg 2048w, https://TheTechMedia.com/wp-content/uploads/2021/07/zomato-new-featured-the-tech-portal-800×550.jpg 800w, https://TheTechMedia.com/wp-content/uploads/2021/07/zomato-new-featured-the-tech-portal-1160×798.jpg 1160w, https://TheTechMedia.com/wp-content/uploads/2021/07/zomato-new-featured-the-tech-portal-e1626320757607.jpg 1074w” sizes=”(max-width: 1024px) 100vw, 1024px”>Zomato, which reported its Q3’2022 results late yesterday, hasn’t seen any respite on the stock markets, despite a decent performance. Losses have shrunk, order volume has grown significantly as users preferred at-home ordering than dine-out and revenues have increased. But the stock, which was already trading towards the bottom end, slumped a further by nearly 5%.

The food delivery platform reported a consolidated loss of ₹63.2 crore for the quarter ended December (Q3FY22), which is almost a fourth of the ₹352.6 crore that the company had reported in the same quarter last year.

Revenue from the operations came in at ₹1,112 crore, up 82.7% against ₹609.4 crore logged in the corresponding quarter of the previous fiscal. On a year-on-year (“YoY”) basis, Zomato saw a 78% growth in Adjusted Revenue to ₹1420 crore ($190 million). However, on a sequential quarter-on-quarter (“QoQ”) basis, it was a flat quarter. Revenue from operations grew by ~9% QoQ, while the customer delivery charges de grew by 22%. This was driven by ₹7.5 per order reduction in customer delivery charges in Q3 FY22 as compared to Q2 FY22.

“The number of orders grew 93 percent YoY and 5 percent QoQ. Average order value (AOV, which includes customer delivery charges) shrunk by ~3% QoQ, mostly on account of a reduction in customer delivery charges,” the company said in its earnings release.

TheTechMedia.com/wp-content/uploads/2022/02/Screenshot-2022-02-11-at-12.29.51-PM-300×248.png 300w” sizes=”(max-width: 710px) 100vw, 710px”>

TheTechMedia.com/wp-content/uploads/2022/02/Screenshot-2022-02-11-at-12.29.51-PM-300×248.png 300w” sizes=”(max-width: 710px) 100vw, 710px”>

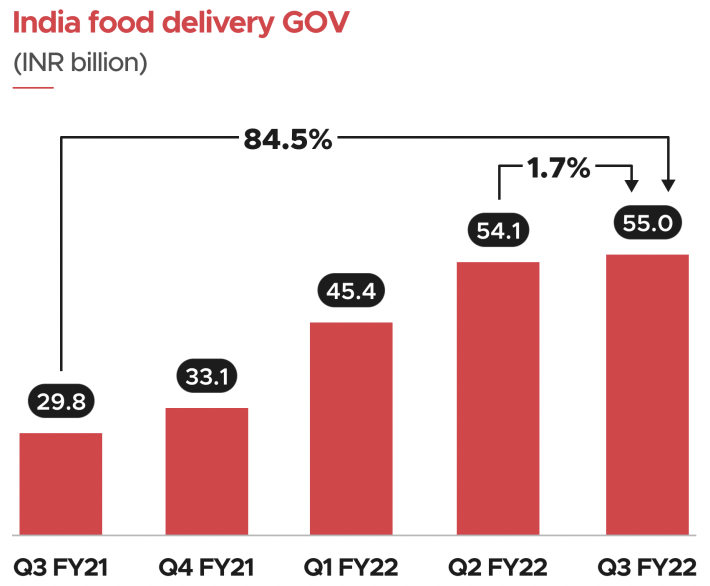

Adjusted EBITDA loss reduced to ₹270 crore ($36 million) in Q3 FY22 as compared to ₹310 crore ($41 million) in the previous quarter (Q2 FY22) driven by “rationalizing spends” across various businesses and functions. Gross Order Value (“GOV”) grew by 84.5% YoY and 1.7% QoQ to ₹5500 crore ($733 million) in Q3 FY22.

Cash in hand looks strong, with the company sitting nicely on a cash pile of $1.2Bn, and is hence not looking to raise any additional investments in the foreseeable future.