Banks facilitating UPI payments will now charge users for peer-to-peer transactions, with an initial 20 transactions being waived off. This came to light through advisories issued by couple of large private sector banks, including Kotak Mahindra Bank and Axis Bank. The charges, which are sure to come as quite a blow to the rapidly growing fintech segment of the Indian economy, will come in to play on April 1st 2020.

Traditionally, charges have been levied by banks for transactions carried out through various means such as NEFT, RTGS, mobile wallets and more. UPI however has been facilitating P2P and P2M transactions free of cost.

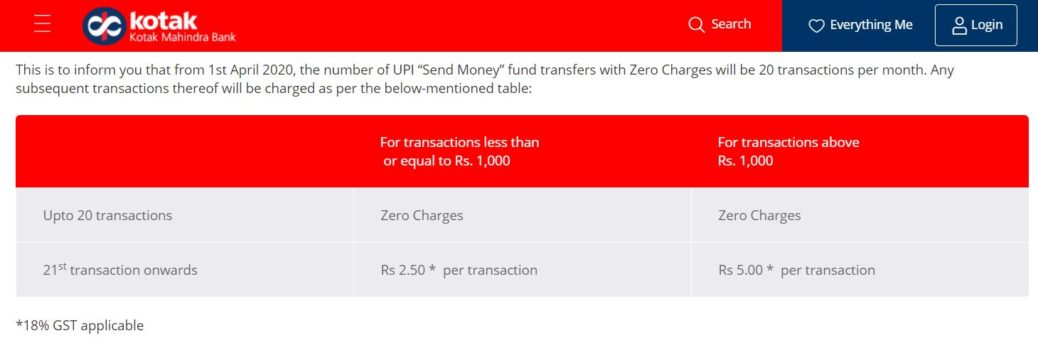

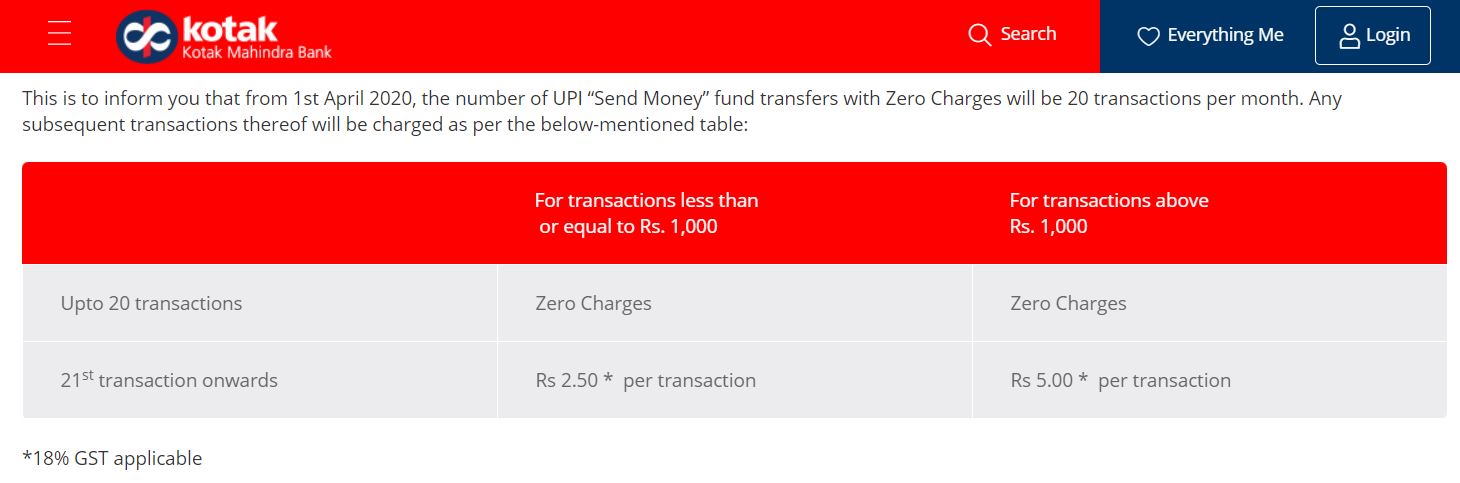

The charges that customers have to shed out are according to the value of the transaction. After the first 20 transactions which will be free of cost, users will have to pay INR 2.5 for transactions under or equal to INR 1000 whereas INR 5 will be charged for transactions above that margin. These are exclusive of GST.

The charges will lead to a rise in the revenues of banks which usually facilitate UPI payments free of cost. These transactions will now generate revenue through either the bank’s own apps or third party apps such as Paytm, PhonePe, Google Pay, Amazon Pay etc.

Launched prior to demonetisation in 2016, the instant real-time payment system has grown to become the backbone of the country’s digital payment industry. The payment tool recorded over 1 Billion monthly transactions in September 2019 while the total transactions added up to 10.78 Billion.

Transactions in the last month added up to about 1.32 Billion and the pattern is expected to continue through March as well. The charges however are expected to cause a sharp decline April onwards.

Last month, the NCPI abolished payment service provider fee on all UPI person-to-merchant transactions until April 30th 2020. The suspension of this fee which generated revenue for banks and UPI apps has made it difficult for these apps to facilitate P2M transactions.